About Us

Established in 2000, CPS Homes have gone from strength to strength over the years.

Blog

All the latest news and gossip in the property world written by our in house team.

Presenting your property

Take a look at our tips to improve a person's perception of your home and encourage those offers to come flooding in!

Watch how Nathan and Sian can help you sell your home...

Our unique approach and concierge-style service will get you the most for your home. Meet the team and find out how we do it!

A unique social media marketing strategy

With our team's unique social media marketing approach, your home reaches the right buyers in all the right places.

Vendor story: Ollie and Liv's journey

Follow Ollie’s story of selling his two-bedroom Cardiff home with the CPS Homes team...

Which landlord service is best for me?

Every landlord has a different reason or different needs when letting a property, so we provide a range of flexible services to suit.

Guaranteed rent service

Your rent paid on time every month – guaranteed. We become your tenant and we’ll pay you even if your property is empty.

11 reasons to trust us with your investment

(We tried to make it 10 but couldn't decide which one to leave out!)

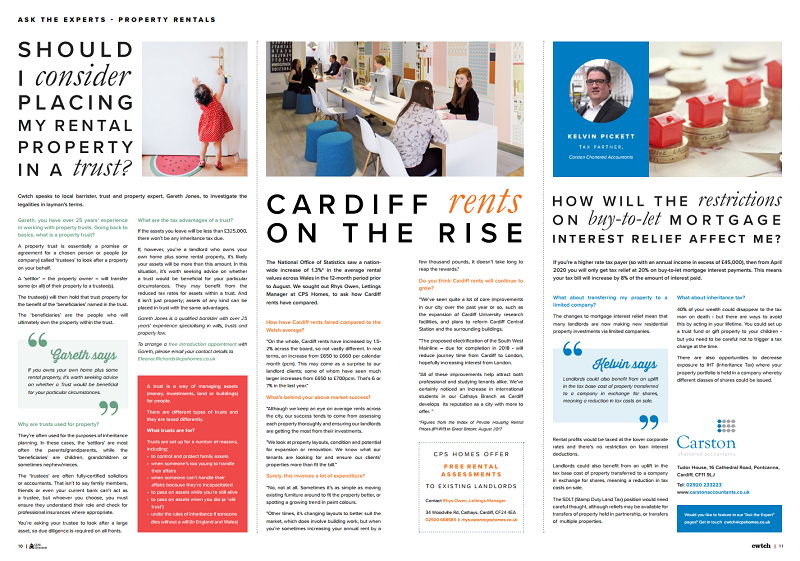

How will the restrictions on buy-to-let mortgage interest relief affect me?

This article first appeared in the Winter 2017 edition of our Cwtch Magazine. Please click on the thumbnail above to read it as it appeared in the magazine.

----

If you’re a higher rate tax payer (so with an annual income in excess of £45,000), then from April 2020 you will only get tax relief at 20% on buy-to-let mortgage interest payments. This means your tax bill will increase by 8% of the amount of interest paid.

What about transferring my property to a limited company?

The changes to mortgage interest relief mean that many landlords are now making new residential property investments via limited companies.

Kelvin says: Landlords could also benefit from an uplift in the tax base cost of property transferred to a company in exchange for shares, meaning a reduction in tax costs on sale.

Rental profits would be taxed at the lower corporate rates and there’s no restriction on loan interest deductions.

Landlords could also benefit from an uplift in the tax base cost of property transferred to a company in exchange for shares, meaning a reduction in tax costs on sale.

The SDLT (Stamp Duty Land Tax) position would need careful thought, although reliefs may be available for transfers of property held in partnership, or transfers of multiple properties.

What about inheritance tax?

40% of your wealth could disappear to the tax man on death - but there are ways to avoid this by acting in your lifetime. You could set up a trust fund or gift property to your children - but you need to be careful not to trigger a tax charge at the time.

There are also opportunities to decrease exposure to IHT (Inheritance Tax) where your property portfolio is held in a company whereby different classes of shares could be issued.

Contact Kelvin on:

Carston Chartered Accountants

Tudor House, 16 Cathedral Road, Pontcanna, Cardiff, CF11 9LJ

Tel: 02920 233223

The information contained within this article was correct at the date of publishing and is not guaranteed to remain correct in the present day.

Posts by date

-

2026

(11)

- January 2026 (8)

- February 2026 (3)

-

2025

(70)

- January 2025 (4)

- February 2025 (1)

- March 2025 (7)

- April 2025 (9)

- May 2025 (9)

- June 2025 (6)

- July 2025 (9)

- August 2025 (5)

- September 2025 (4)

- October 2025 (7)

- November 2025 (6)

- December 2025 (3)

-

2024

(63)

- January 2024 (6)

- February 2024 (6)

- March 2024 (5)

- April 2024 (5)

- May 2024 (5)

- June 2024 (4)

- July 2024 (4)

- August 2024 (3)

- September 2024 (12)

- October 2024 (5)

- November 2024 (5)

- December 2024 (3)

-

2023

(74)

- January 2023 (9)

- February 2023 (6)

- March 2023 (9)

- April 2023 (11)

- May 2023 (9)

- June 2023 (4)

- July 2023 (3)

- August 2023 (8)

- September 2023 (3)

- October 2023 (2)

- November 2023 (8)

- December 2023 (2)

-

2022

(98)

- January 2022 (12)

- February 2022 (4)

- March 2022 (9)

- April 2022 (6)

- May 2022 (10)

- June 2022 (11)

- July 2022 (5)

- August 2022 (7)

- September 2022 (8)

- October 2022 (8)

- November 2022 (12)

- December 2022 (6)

-

2021

(81)

- January 2021 (5)

- February 2021 (6)

- March 2021 (8)

- April 2021 (7)

- May 2021 (5)

- June 2021 (8)

- July 2021 (5)

- August 2021 (9)

- September 2021 (8)

- October 2021 (6)

- November 2021 (6)

- December 2021 (8)

-

2020

(93)

- January 2020 (5)

- February 2020 (7)

- March 2020 (10)

- April 2020 (7)

- May 2020 (8)

- June 2020 (4)

- July 2020 (7)

- August 2020 (6)

- September 2020 (10)

- October 2020 (5)

- November 2020 (13)

- December 2020 (11)

-

2019

(84)

- January 2019 (5)

- February 2019 (4)

- March 2019 (7)

- April 2019 (6)

- May 2019 (10)

- June 2019 (7)

- July 2019 (13)

- August 2019 (10)

- September 2019 (8)

- October 2019 (5)

- November 2019 (4)

- December 2019 (5)

-

2018

(70)

- January 2018 (6)

- February 2018 (5)

- March 2018 (8)

- April 2018 (7)

- May 2018 (5)

- June 2018 (4)

- July 2018 (4)

- August 2018 (7)

- September 2018 (9)

- October 2018 (5)

- November 2018 (4)

- December 2018 (6)

-

2017

(96)

- January 2017 (5)

- February 2017 (7)

- March 2017 (8)

- April 2017 (4)

- May 2017 (7)

- June 2017 (9)

- July 2017 (7)

- August 2017 (10)

- September 2017 (10)

- October 2017 (8)

- November 2017 (10)

- December 2017 (11)

-

2016

(85)

- January 2016 (4)

- February 2016 (8)

- March 2016 (7)

- April 2016 (9)

- May 2016 (9)

- June 2016 (8)

- July 2016 (7)

- August 2016 (5)

- September 2016 (7)

- October 2016 (8)

- November 2016 (6)

- December 2016 (7)

-

2015

(79)

- January 2015 (10)

- February 2015 (7)

- March 2015 (4)

- April 2015 (6)

- May 2015 (9)

- June 2015 (7)

- July 2015 (5)

- August 2015 (5)

- September 2015 (5)

- October 2015 (8)

- November 2015 (7)

- December 2015 (6)

-

2014

(72)

- January 2014 (7)

- February 2014 (4)

- March 2014 (8)

- April 2014 (11)

- May 2014 (4)

- June 2014 (6)

- July 2014 (8)

- August 2014 (5)

- September 2014 (4)

- October 2014 (7)

- November 2014 (4)

- December 2014 (4)

-

2013

(76)

- January 2013 (3)

- February 2013 (10)

- March 2013 (2)

- April 2013 (4)

- May 2013 (5)

- June 2013 (4)

- July 2013 (11)

- August 2013 (4)

- September 2013 (8)

- October 2013 (9)

- November 2013 (7)

- December 2013 (9)

-

2012

(62)

- January 2012 (3)

- February 2012 (4)

- March 2012 (5)

- April 2012 (3)

- May 2012 (4)

- June 2012 (3)

- July 2012 (5)

- August 2012 (9)

- September 2012 (4)

- October 2012 (6)

- November 2012 (6)

- December 2012 (10)

-

2011

(45)

- January 2011 (5)

- February 2011 (2)

- March 2011 (8)

- April 2011 (5)

- May 2011 (3)

- June 2011 (2)

- July 2011 (2)

- August 2011 (2)

- September 2011 (4)

- October 2011 (3)

- November 2011 (5)

- December 2011 (4)

-

2010

(50)

- January 2010 (2)

- February 2010 (3)

- March 2010 (6)

- April 2010 (6)

- May 2010 (5)

- June 2010 (4)

- August 2010 (2)

- September 2010 (5)

- October 2010 (2)

- November 2010 (11)

- December 2010 (4)

-

2009

(53)

- January 2009 (4)

- February 2009 (7)

- March 2009 (9)

- April 2009 (6)

- May 2009 (9)

- June 2009 (7)

- July 2009 (1)

- October 2009 (2)

- November 2009 (8)

-

2008

(14)

- January 2008 (1)

- February 2008 (1)

- April 2008 (2)

- May 2008 (1)

- August 2008 (1)

- September 2008 (3)

- October 2008 (3)

- December 2008 (2)

-

2007

(27)

- January 2007 (6)

- February 2007 (2)

- March 2007 (1)

- April 2007 (2)

- May 2007 (1)

- June 2007 (6)

- July 2007 (3)

- August 2007 (1)

- October 2007 (2)

- November 2007 (2)

- December 2007 (1)

-

2006

(22)

- January 2006 (3)

- March 2006 (2)

- April 2006 (4)

- May 2006 (3)

- August 2006 (6)

- September 2006 (2)

- November 2006 (2)

-

2005

(2)

- November 2005 (1)

- December 2005 (1)

What landlords in Wales need to know about the new EPC & MEES rules

What landlords in Wales need to know about the new EPC & MEES rules

Don+#8217;t miss an update ever again +#8211; stay informed all year-round signing up for our landlord newsletter.A clear, practical guide to minimum energy efficiency standards from 2030The rules around energy …