The little-known council tax trap when letting room-by-room

If you’re considering letting your property room-by-room, it’s important to be aware of a potential council tax trap that can catch landlords out – and significantly increase costs.

It relates to how the property is valued for council tax purposes, and the role of the Valuation Office Agency (VOA) in determining that value.

Who are the VOA – and what do they do?

The VOA is the government body responsible for assigning council tax bands to all domestic properties in England and Wales. These bands (A–I in Wales) are based on the property’s value (albeit very dated values!).

Most properties let room-by-room have a single council tax band, meaning the whole property is billed once, with the landlord liable for the cost. In practice, landlords usually include the council tax within the rent to ensure they’re not left out of pocket.

However, in HMOs where tenants occupy only part of the property on an individual basis, the VOA has the discretion to assign separate council tax bands to each room — effectively treating them as self-contained units. That’s when problems can start.

How this can affect landlords

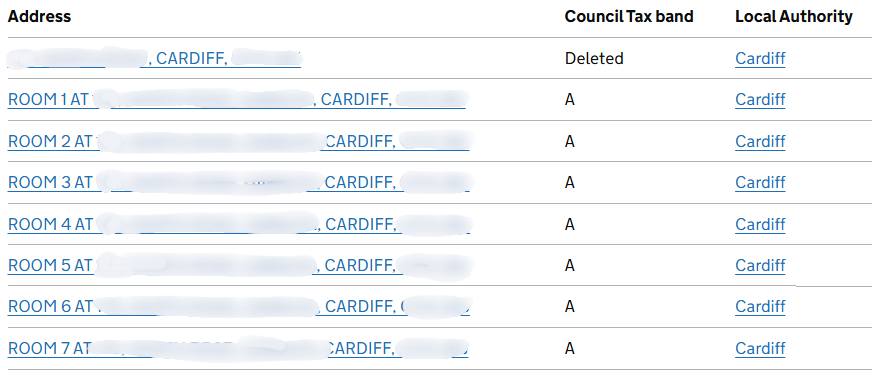

We know of one case where the VOA has re-banded a property let as seven individual rooms from a single Band D dwelling (council tax approx. £1,900 per year) to 7 x Band A rooms, resulting in a total bill close to £9,000 per year.

Like most do, the landlord had council tax included in the rent, so they had no choice but to absorb the entire increase — wiping out a large chunk of their rental income in the process.

It’s worth noting that this isn’t something Cardiff Council decides. They simply follow the VOA’s instructions - often with little or no warning.

Additionally, there seems to be little consistency to the properties targeted by the VOA. You could have two very similar properties on the same street, both let room-by-room, and only one is banded as individual rooms. We suspect a trigger might be a recent planning application or building works, but even that’s not guaranteed.

What happens if your property is re-banded room-by-room?

If, like the landlord described above, you include council tax in the rent, you’ll have little choice but to absorb the extra cost until you're able to renegotiate the rent with the tenant. Unless they’re willing to mutually agree a change during their current fixed-term (unlikely), you’ll need to wait until you’re renewing for a new fixed-term or the contract has gone periodic.

Once the VOA has applied separate bands to each room, the council can set up individual accounts in tenants’ names and bill them directly. In that scenario, landlords often choose to exclude council tax from the rent and have tenants pay it straight to the council instead. However, that shift usually results in tenants paying more than they were previously, which could affect whether they choose to remain in the property.

This is an unpredictable and hard-to-control scenario – and something landlords should have in mind before opting for a room-by-room arrangement.

A change on the horizon?

Welsh Government recently consulted on this issue and is proposing to stop the VOA from banding rooms individually in HMOs altogether. Under the proposals, all HMOs would be valued and billed as a single property – restoring predictability to the system and helping keep costs manageable for tenants and landlords alike.

The consultation closed in late 2024 and the outcome is still pending, but we’ll update landlords as soon as any changes are confirmed.

Our advice to landlords

At CPS Homes, we manage HMOs let both room-by-room and on single, joint tenancies. While there are situations where a room-by-room setup is necessary, we almost always recommend a single, joint tenancy wherever possible.

There are several reasons for this:

- Council tax liability remains with the tenants under a joint tenancy, so landlords don’t need to include it (or utility bills) within the rent.

- Tenant turnover is usually lower, meaning fewer check-ins, deposit returns, inventories and other admin.

- Responsibility for shared areas is clearer. If there’s damage to a communal space – say, a burn in the lounge carpet – it’s often impossible to attribute it to a single tenant under a room-by-room let. Most landlords in this position end up absorbing the cost.

- There’s more legal risk under a room-by-room let, as landlords become responsible for the non-domestic areas of the property (i.e. the shared spaces), which must be included in a formal fire risk assessment.

If you're unsure about the best approach for your property – or you’re already letting room-by-room and want to explore your options – we’d be happy to help you put a plan together.

Just get in touch with the team for advice tailored to your portfolio. Email lettings@cpshomes.co.uk or call 02920 668585.

The information contained within this article was correct at the date of publishing and is not guaranteed to remain correct in the present day.