RLA back landlords as they seek government support to improve energy efficiency

Landlords across the UK are calling for support from the government following recent changes to energy performance requirements for private rented properties.

Landlords across the UK are calling for support from the government following recent changes to energy performance requirements for private rented properties.

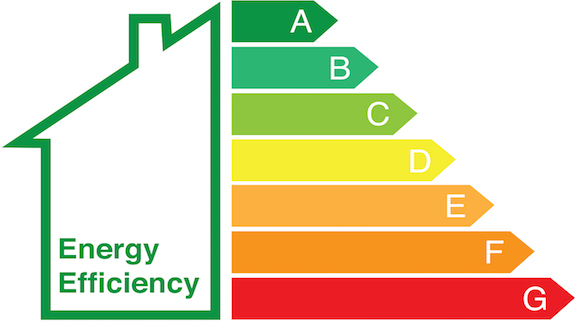

Earlier this year a new requirement was introduced, meaning that all new or renewed private tenancies are now required to have rental properties that are rated as at least an 'E' grade on their Energy Performance Certificate (EPC). By 2020 this will apply to all private rented properties.

It has been suggested that the Government are likely to increase the target further by 2030, with all private rented properties eventually requiring at least a 'C' grade rating. The Residential Landlords Association (RLA) are now suggesting that policy makers should be providing support to landlords so that they can be better prepared to make the necessary improvements to meet the required energy performance criteria.

RLA claim that recommended work should be tax deductible

The RLA are calling for all required work that is recommended on an EPC and carried out by landlords on their rental properties to be considered a tax deductible repair, and they will include this in their forthcoming submission to the Treasury ahead of the budget.This sort of support would make things a little more affordable for landlords as they undertake the work that is required to ensure their EPC rating meets the required standard, and would also encourage an ongoing culture of continuous improvement to rental homes as opposed to just setting an EPC target and leaving it there.

PEARL, the research lab of the RLA, discovered that 37% of landlords with properties rated at 'F' or 'G' are currently unable to afford the costs that are required to bring the property up to the minimum 'E' rating threshold.

Average improvement costs to meet required EPC is £5,800

These landlords have reported that it would cost around £5,800 on average to improve the energy efficiency of their properties to the required standard.

Previous research by PEARL also revealed that 61% of landlords would be encouraged to implement improvements on their rental properties if the government were to introduce tax relief for any work that is related to energy efficiency.

Figures show that energy performance ratings on the whole are heading in the right direction, as in 2006 just over 25% of private rented homes had an energy performance rating of 'F' or 'G', and by 2016 that had dropped to under 7%. It's likely that recent figures for 2018 would show that this improvement has been maintained or even improved further.

Energy efficient homes are good for both tenants and landlords alike, and this is the main reason the RLA believe it's important for taxation to be utilised far better than it is at present so that a culture of continuous improvement can be fostered to ensure private rental homes are consistently maximising their EPC potential.

Here at CPS Homes, we're experts in all things property. So, if you're a landlord in Cardiff looking to source the perfect tenants, or if you're a prospective tenant looking to find your dream rental property, then don't hesitate to get in touch with our friendly team today. You can call us on 02920 668585, e-mail enquiries@cpshomes.co.uk or call into one of our three branches located in Roath, Cathays and Cardiff Bay.

The information contained within this article was correct at the date of publishing and is not guaranteed to remain correct in the present day.